09 Jul Loan Forgiveness Deadlines Are Fast Approaching

Paycheck Protection Program Loans:

Loan Forgiveness Deadlines Are Fast Approaching

Established under the Coronavirus Aid, Relief and Economic Security (CARES) Act, the Paycheck Protection Program (PPP) allocated $349 billion in forgivable loans to small businesses in order to pay their employees during the COVID-19 crisis. What seemed like a lifetime away at the time, the forgiveness application deadlines for these loans have arrived. It is important for business owners to make sure their forgiveness applications are timely filed with their financial institution prior to their respective deadline so they are not left on the hook for the loan balance, with their deferred payments beginning relatively soon.

Loans will receive forgiveness if the funds were used for eligible expenses and all employee retention criteria are met. For any not forgiven, the loans have an interest rate of 1%. Loans issued prior to June 5, 2020, have a maturity of two years. Loans issued after June 5, 2020, have a maturity of five years. If a borrower does not apply for loan forgiveness, payments are deferred 10 months after the end of the covered period (24 weeks) for the borrower’s loan forgiveness. This means that forgiveness applications need to be submitted by this calculated date.

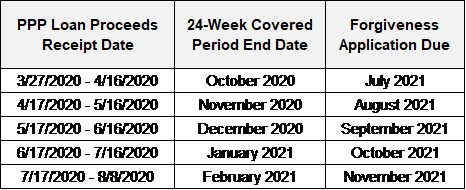

Below is a schedule of when loan forgiveness applications are tentatively due based on receipt of proceeds. Please note these are estimated dates. Businesses should contact their financial institution or prepare their own projection to determine when their loan payments begin and their forgiveness application is due.

Fuller Lowenberg is offering assistance to clients in the preparation or review of PPP Loan Forgiveness Applications. If you would like to engage our firm to assist with the process, please let us know and we will coordinate directly to discuss next steps to start the process. Clients of our firm should contact the partner for your business to inform them of your forgiveness application status or if you need any assistance completing the forgiveness application.

Sorry, the comment form is closed at this time.