20 Apr Forgiveness of the COVID-19 Payroll Protection Program

What Businesses Need to Know About Loan Forgiveness

Established under the Coronavirus Aid, Relief and Economic Security (CARES) Act, the Payroll Protection Program (PPP) allocated $349 billion in forgivable loans to small businesses in order to pay their employees during the COVID-19 crisis. While the SBA’s funds dried up rather quickly, those businesses that were accepted and received loans are now able to pay their employees and meet other obligations in the short-term.

While the headline of the PPP was the forgivable feature, employers need to be aware of the terms of the loan forgiveness and how to proceed in the weeks following the receipt of the loan proceeds. While future details are sure to be released, understanding each of the components of the forgiveness calculation now is important in order for companies to maximize the amounts to be forgiven.

Forgivable Costs

There are four main categories of expenses that are detailed in the CARES Act and your PPP loan is forgivable to the extent the loan proceeds are used on these qualified expenses. Keep in mind that as this is a payroll-focused initiative, loan forgiveness is contingent on maintaining employee headcount and salaries at the pre-COVID-19 level. In addition, these expenses must be paid during the covered 8-week period immediately after the receipt of the loan proceeds. Any amounts spent following the 8-week period or outside one of the below categories, are not forgivable:

- Payroll Costs – Payroll Costs include gross salaries, wages, and tips, up to $100,000 of annualized pay per employee (for the 8-week covered period, a maximum of $15,385 per individual), employer-paid health insurance for employees (not for owners), employer-paid 401k matching contributions, and employer-paid state unemployment and MCTMT taxes. Payroll costs do not include the employer’s portion of payroll tax expenses. An added requirement of the forgiveness is that at least 75% of the loan proceeds must be attributable to these payroll costs (although spending less than 75% of the loan proceeds on payroll costs should still result in having part of the loan forgiven).

- Utilities – Utility costs includes electricity, gas, water, transportation, telephone, or internet service for which service began before February 15, 2020.

- Rent Obligations – Rent includes applicable payments under a lease agreement for real property in force before February 15, 2020.

- Interest – Interest paid on covered mortgage obligations that are a liability of the borrower incurred before February 15, 2020 can be forgiven. The underlying debt must be a mortgage on real or personal property and does include debt on real property that is secured by a mortgage lien or working capital lines of credit where a lien is filed on the borrower’s personal property. Not included in interest payments is that paid toward unsecured debt or payments of principal.

Maximum Forgiveness Calculation

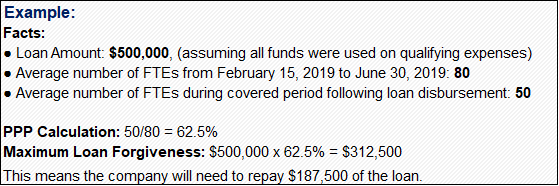

Once it has been determined which payments are eligible for forgiveness, two calculations need to be completed: Measurement of Full-Time Equivalent (“FTEs”) employees and Measurement of actual salary expense. The purpose of these calculations is to ensure that debt forgiveness is directly related to the purpose of the PPP and that is to keep employees working at wages comparable to their pre-COVID-19 level.

Measurement of Full-Time Equivalent (“FTEs”) Employees

There are three (3) different options to determine the covered base period and it is at the employer’s discretion as to which one is used based on which is most favorable to them.

- 2019 Information – the average number of FTEs per month from February 15, 2019 through June 30, 2019

- 2020 Information – the average number of FTEs per month from January 1, 2020 to February 29, 2020

- Seasonal Businesses – the average number of FTEs per month from February 15, 2019 through June 30, 2019

**See possible correction opportunities below in the Forgiveness Reduction Correction section.

Measurement of actual salary expense

The second calculation is required to penalize companies who reduced wages per employee by more than 25% compared to the most recent quarter before the PPP loan was made. For this calculation, businesses need to only consider employees who make $100,000 or less per year. To minimize the reduction of forgiveness, employers should restore their employees’ salaries to the amounts paid in the first quarter of 2020.

Reduction in Forgiveness

In summary, the amount of the PPP Loan forgiveness will be reduced in the following steps:

- Reduction for the amount of non-payroll costs that exceed 25% of the loan proceeds.

- Reduction by applying the Full-Time Equivalent ratio to the maximum loan forgiveness amount, already reduced by Step 1.

- Reduction by any amount of employee wages (on an individual basis) that have decreased in excess of 25% since the most recent quarterly payroll filing.

All steps are independent of each other, but are all applicable forgiveness restrictions.

Forgiveness Reduction Correction

The CARES Act allows for business to remedy any reduction in the forgiveness as it relates to full-time equivalent employees. In the event that there was a reduction of employees during the period between February 15, 2020 and April 26, 2020, as long as they are rehired by June 30, 2020, the FTE calculation for the number in the calculation will treat those rehired employees as if they were included in the entire 8-week period. You have until June 30, 2020 to restore your full-time employment and salary levels for any changes made during this period. It is currently unclear how the mechanics of this remedy would occur but further guidance is expected.

What To Do Next

The loan forgiveness process will be administered by your bank and it is expected that an abundance of supporting documentation is going to be required in order to validate the eligible costs. Once the loan is received, it is important to be diligent and strategic when deciding on how the funds should be disbursed and how to bring your employees back to your business in order to receive the maximum amount of loan forgiveness.

Sorry, the comment form is closed at this time.