02 Jul Advance Child Tax Credit Payments

Beginning July 15, 2021, the IRS will automatically begin to distribute equal, monthly payments as an advance of the 2021 Child Tax Credit that would normally be received when filing your 2021 Individual income tax return. Under the American Rescue Plan Act, if you claimed the Child Tax Credit on either your 2019 or 2020 Individual tax return, then you are eligible to receive these advance payments.

For tax year 2021, the Child Tax Credit has been increased to $3,600 for children ages 5 and under, and $3,000 for children ages 6 through 17. Because the advances are equal to 50% of these amounts, you would be receiving six (6) equal payments of $300, for a total of $1,800, if your qualifying child(ren) is under the age of 6 during 2021. The payments would decrease to $250 per month if your qualifying child(ren) are over the age of 6 and under the age of 18. There are income thresholds where the credit may be subject to a phase-out, which are broken out below.

The IRS currently has a portal available that will inform you whether or not you are eligible to receive the payment, an option to elect out of the automatic payments, and the ability to change your bank information if the IRS database is not up-to-date. Further updates to this portal will allow you to change your filing status and add/remove dependents that you will/plan to claim on your 2021 individual income tax return. When you file your 2021 individual income tax return you will be able to claim the remaining 50%. Any advance payments you do not receive during the year will be reconciled on your individual income tax return so that you will receive the full amount of the credit.

Prior to 2021, the Child Tax Credit was $2,000 per “qualifying child” reported and claimed on your individual tax return. The American Rescue Plan Act increased the Child Tax Credit to $3,600 for children ages 5 and under, and $3,000 for children ages 6 through 17. The Child Tax Credit will be reduced by $50 for each $1,000 your modified Adjusted Gross Income (AG) for 2021 exceeds:

- $150,000 if married and filing a joint return or if filing as a qualifying widow or widower

- $112,500 if filing as head of household

- $75,000 if you are a single filer or are married and filing a separate return

The Child Tax Credit can also be reduced below $2,000 per qualifying child if your modified AGI exceeds the following income threshold:

- $400,000 if married and filing a joint return

- $200,000 for all other filing statuses

A “qualifying child” is an individual who does not turn 18 before the end of the respective tax year, and satisfies all of the following conditions:

- The individual is the taxpayer’s son, daughter, stepchild, eligible foster child, brother, sister, stepbrother, stepsister, half-brother, half-sister, or a descendant of any of them

- The individual does not provide more than one-half of his or her own support during the year

- The individual lives with the taxpayer for more than one-half of the year

- The individual is properly claimed as the taxpayer’s dependent

- The individual does not file a joint return with the individual’s spouse for tax year 2021 or files it only to claim a refund of withheld income tax or estimated tax paid

If you prefer not to receive the monthly advance Child Tax Credit payments because you would rather claim the full credit when you file your 2021 individual tax return, or you will not be eligible to claim the Child Tax Credit for the year, then you will have to log into the Child Tax Credit Update Portal (CTC UP) on the irs.gov website and elect out of these payments. The first payment is scheduled to be disbursed on July 15, 2021 so the window to opt-out has already passed, but going forward the deadline to opt-out will be 3 days prior to the first Thursday of that month. For example, if you would like to opt-out of the August 13th payment, you must do so prior to August 2nd. If you are a married taxpayer interested in opting out, both you and your spouse must log into the portal and individually opt-out. If only one spouse is to opt-out, then the IRS will process half of the calculated monthly payment.

The advanced payments will be disbursed on a monthly basis and will be electronically deposited to your bank account if the IRS already has your banking information on file. They would have this information if you have previously received a direct deposit tax refund, or if a direct debit was used to pay a tax liability.

In January 2022, the IRS will send you Letter 6419 to provide the total of the advanced Child Tax Credit payments that were disbursed during 2021. Please hold onto this letter as this will be important when filing your 2021 Individual tax return. The Child Tax Credit Update Portal is currently available on the IRS.gov website and there will be further updates in the upcoming weeks. There are no indications that these monthly payments will be extended into 2022 but we will continue to monitor all updates as they are released.

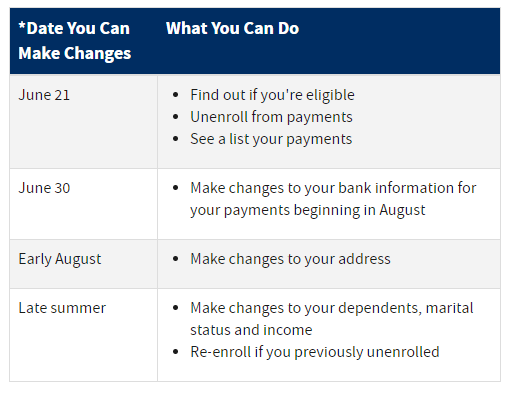

The IRS has provided the below tentative schedules regarding the timing of when the updates will be available, along with a schedule of the various deadlines if you would like to opt-out of the monthly payments:

Visit the IRS : Advanced Child Tax Credit Payments

Get a printable .pdf version: www.flcpas.com Advance Child Tax Credit Payment

Sorry, the comment form is closed at this time.